客製紋身貼紙 / 裁型貼紙 – 品牌客製紋身貼紙專家

品質最優

服務最好

效果最讚

好評最多

偏好以描述的方式告知您的客製需求?您也可以點選「需求報價」,以問答的方式寫下您的需求

需求報價微客製 - 從精選商品中挑選

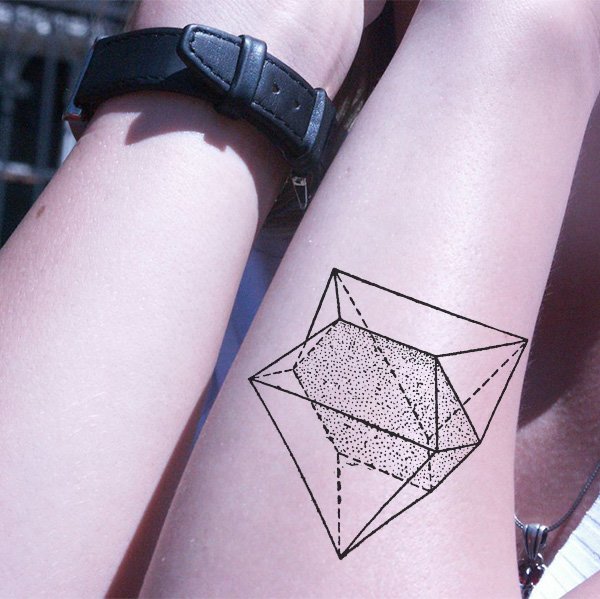

紋身貼紙

彩色紋身貼紙

彩色紋身貼紙

彩色紋身貼紙

彩色紋身貼紙

彩色紋身貼紙

彩色紋身貼紙

裁型貼紙

彩色紋身貼紙

彩色紋身貼紙

彩色紋身貼紙

這些人都用了潮貼在他們的行銷活動

文創商品的極品推手

我是設計師,很謝謝有潮貼對品質的堅持,幫我把我的作品變成這麼棒的商品,專業的大量印刷與包裝,讓我更專注於創作,太愛你們了,有你們真好^.<

囧**

公司發表會的好幫手

很謝謝有你們,小量印製快速又精美,宣傳效果醒目,會場好多同業都在問,我們家麻豆貼的紋身貼紙效果好好啊。

科技公司採購-黃**

明星粉絲後援會

收到囉,超讚的^^b謝謝你們!!!我會再光顧的:)我有介紹出去了,粉絲們都很喜歡^_^

愛**

三鐵運動

紋身貼紙品質很好,游泳運動後效果也還是好啊!!比其他活動拿到的品質好很多喔:)

李**

客製紋身貼紙

已經收到紋身貼紙了,商品品質很好,包裝也很細心:)非常感謝~

石**

客製紋身貼紙

已經收到美美的!期待周日… 兒童联合國兒童基金路跑

Thank you

HK-Peggy

服裝秀

很滿意潮貼提供專業建議,讓我們製作適當的紋身貼紙尺寸,紋身貼紙舞台走秀效果很好喔!

歐洲品牌代理

紋身圖案設計很美

你們的紋身圖案設計很美哦,謝謝!

HK-Ronnie

品質很好

貨品已收到,品質非常好,非常謝謝~♥

Albee

圖庫推薦

網站上圖庫裡看到很多很可愛好用ㄌ的圖案,不用再多做設計就很好看了

李**

刺青貼紙

昨天收到貼紙了~很喜歡~~謝謝^^

dotdot

活動好幫手

活動已經順利結束了!大家對於刺青貼紙好評不斷,謝謝您的大力協助,真的是非常感激,期待下一次的合作!

鄭**

好物推薦

今天已收到貨了喔,我很滿意,謝謝:)下次會再跟你們訂製!!!!

向**

公司活動-紋身貼紙

我收到嚕收到嚕~大感謝哇~XD超棒的啦,感謝您們唷^____^

Ariel

愉快交易

已收到您們製作的紋身貼紙,非常喜歡,感謝~

Sabrina

超感動服務

也畫得太棒了吧!!!太感謝你們了,還有,你們效率真的讓我感動!!! 我很滿意,謝謝:)

Carol

優質商品與服務

今天已經成功收到深深貼紙商品了,出貨速度快而且貼紙很漂亮,真的非常感謝您們的協助與配合。期待下次有機會希望可以再訂製你們的商品,thank you:)

燕*

人物素描紋身貼紙

很喜歡你們的紋身貼紙,刺在身上給外婆的驚喜!

黃**

公司LOGO紋身貼紙採購

品質又好又快,急件幫忙處理,謝謝您!

Kay

照片素描處理,給男友的生日驚喜

紋身貼紙商品我收到了,很棒!太感謝你們了,謝謝唷~

顏**

手繪紋身貼-又來購買囉

收到了,很喜歡♡謝謝你們,貼上自己手繪的紋身貼紙,感覺真的很棒!

蘇**

買了又買

超擬真紋身貼紙,太讚了!買好幾次囉^^b

YoungYoung

紋身貼紙

收到了,非常感謝!孩子們很喜歡~~

陳老師 2015-04-30

婚禮紋身小物

收到成品囉!好喜歡^_^大感謝*^O^*

Iris

電影拍攝

紋身貼紙品質很好,讓拍攝效果很好喔!

電影劇組-林**

急件幫忙

謝謝你們,品質好效率高,急件特別幫忙,超感謝!

HK-Mirmanda

愉快交易

感謝喔!收到紋身貼紙了,很開心:)

Manda

很棒的交易

成品很精美:)我們十分欣賞貴公司的效率,謝謝你們。

HK-Howard

購買評價

已收到貨品,品質很好,謝謝!

HK-胡**

紋身貼紙實品很漂亮

實品收到了!真的很漂亮喔!大家都很喜歡^_^我會幫你們多多宣傳的~~~

曾**

很棒的交易

一直忘記要回覆你們!紋身貼紙已經收到好幾天了,謝謝你們整個過程的幫忙。產品很有質感,出貨也很有效率,是個很棒的賣家!再次感謝囉!:)

Carol